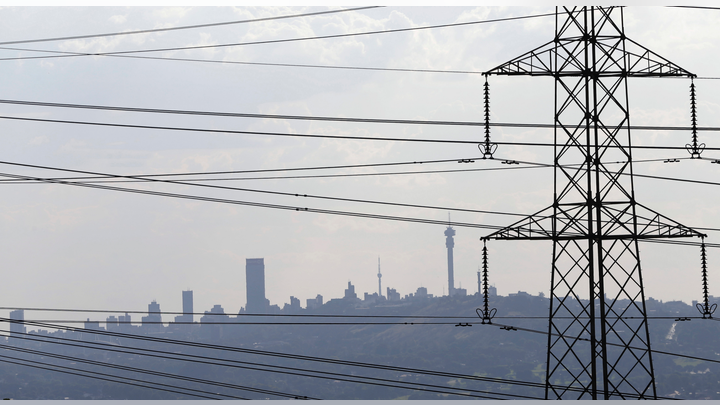

South Africa’s new Electricity Transmission Infrastructure Regulations, effective from 31 October 2025, mark one of the most important shifts in the country’s energy policy in over a decade. They change who can build transmission infrastructure, who pays for it, how private companies participate, and how quickly new lines can connect renewable energy to the grid.

But whenever rules change, the question everyone asks is simple: Who wins—and who loses?

Here is a clear, practical breakdown.

WINNERS

1. Renewable Energy Developers (IPP Solar, Wind, Storage)

These Regulations are a massive win for Independent Power Producers.

Why they win:

- Faster approvals for new transmission lines

- Clearer procurement rules

- Stronger alignment between project timelines and grid build-out

- The Minister can now deviate from the IRP/TDP for urgent needs—helpful when bottlenecks block renewable projects

For years, developers built solar and wind farms only to discover the grid had no space. Under the new system, transmission expansion can finally move at the same speed as South Africa’s renewable industry.

2. Private Investors & Infrastructure Funds

South Africa’s grid needs more than R390 billion by 2035. Eskom cannot finance this alone.

Big win: Private companies can now invest, build, or operate transmission infrastructure under a formal framework with guaranteed cost-recovery.

NERSA must ensure investors can recover:

- Development costs

- Land and servitude expenses

- Payments under transmission service agreements

- Termination and administrative costs

This makes transmission a bankable asset class for pension funds, DFIs, institutional investors, and global infrastructure players.

3. Grid Technology Companies

With tens of thousands of kilometres of new lines needed, companies in:

- transmission equipment

- high-voltage cables

- substations

- transformers

- digital grid solutions

…will see very high demand.

The new Regulations create predictable procurement cycles for a decade, gold for OEMs and EPCs.

4. Regional Power Trade (SAPP, Cross-Border Utilities)

Regulation 8 strengthens South Africa’s ability to build transmission lines that connect to neighbouring countries—as long as government-to-government agreements are in place.

Winners include:

- Zambia

- Mozambique

- Namibia

- Botswana

- Zimbabwe

- SAPP market operators

This can unlock cheaper imports, higher exports, and a more stable regional grid.

LOSERS

1. Slow or Unprepared Developers

The bar to participate is now higher.

Projects without:

- feasibility studies

- clear financing

- strong risk allocation

- proper technical due diligence

…will fall behind quickly. The new regime rewards discipline, speed, and compliance.

2. Entities Expecting Eskom to Remain the Only Builder

The old monopoly model is gone. Companies or consultants relying on Eskom-only projects will lose market share to private transmission operators and new procurement agents.

Read Also: South Africa Faces Prospect of Sharp Electricity Price Increases as Court Delay Looms

3. Grid-Constrained Regions Without Ready Projects

Areas where renewable developers are not active may not benefit soon. Transmission expansion will prioritise high-impact corridors first.

4. Stakeholders Resistant to Transparency

Procurement must now be:

- transparent

- competitive

- benchmarked

- backed by feasibility studies

Opaque deals and political gatekeeping will find far less room to operate.

By Thuita Gatero, Managing Editor, Africa Digest News. He specializes in conversations around data centers, AI, cloud infrastructure, and energy.